PV is now in a balanced market while Scottsdale is still experiencing a weak sellers market–heading quickly towards a balanced market. Last month we reported that housing inventory was on the rise and indeed, inventory across the county has continued to pile up. Let’s jump into my Scottsdale and Paradise Valley market update for October sales data 2024. There are currently 2298 active listings between Scottsdale and PV and those listings have been on the market an average of 105 days.

Scottsdale Under $2M

In the Scottsdale sub-luxury market, there are 1560 active listing and 472 properties under contract. There are 51 “coming soon” listings and in the month of October, there were 415 closed sales. The closed sales were on the market for an average of 75 days and closed for an average of $407/sf–down slightly from September.

Scottsdale Luxury

At the luxury end of the Scottsdale market, there are 527 active listings–as a comparison, there were 445 active listings at the end of September. There are 218 pending sales and 18 “coming soon” listings. In October there were 63 sales that were on the market for an average of 91 days and sold on average for $692/sf.

PV Luxe

As expected, there was another massive jump in active inventory since the end of September. There are currently 236 active listings in Paradise Valley which have been on the market an average of 127 days. There are 37 properties under contract and just four “coming soon” listings. From October 1, 2024 to October 31, 2024, there have been 14 sales ranging in price from $2.1M to $12,250,000. Here are some MLS stats for recently closed sales:

- Average days on market: 92

- Average list to sale price ratio: .97

- Average sold price per square foot: $937 (skewed high due to one property that sold for almost $2000/sf)

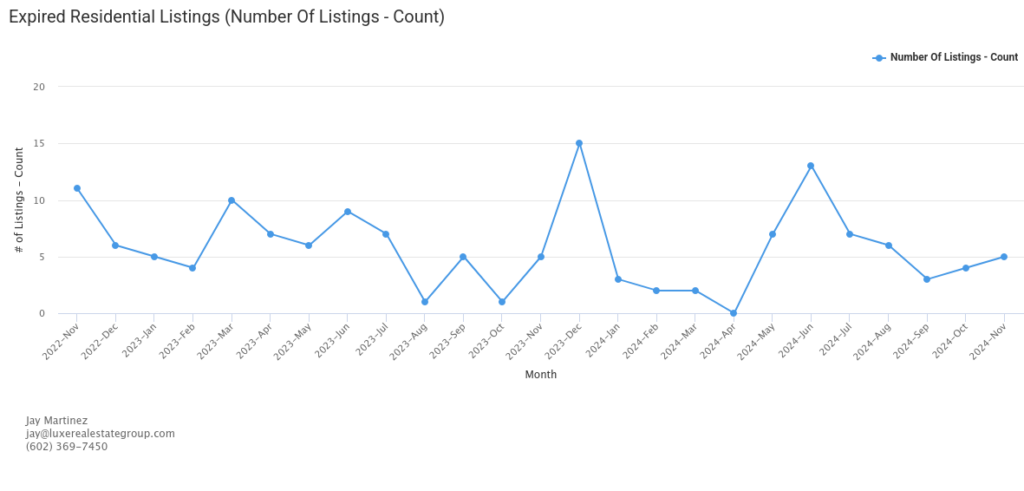

The number of expired listings can often times point to the health of a market. This graph shows the number of expired listings in PV over the past two years–expired listings have risen the past two months.

Market Summary

Housing inventory across the Phoenix metro area has continued to rise over the past 30 days and while there are a few cities/towns left that are experiencing very sellers markets, it does appear that most areas around the valley are either in a buyer’s market or a balanced (flat) market. The contract ratio, which is the number of homes under contract versus the number listed, has been dropping for months and for only the third time in the past 15 years, supply is exceeding demand. The Fed is meeting again in mid-December and we may see a rate cut–if it translates to lower home loan rates, we may see the market pick up by the end of January or February….barring some insane global event or major market disruption.